The 10-year U.S. treasuries yield serves as a critical benchmark for global finance around the world and often is the most closely watched index for risk-return assessments of many investment vehicles in capital markets. The recent reports about China halting its purchases of U.S. government debt have many investors concerned and searching for answers regarding the long- and short-term effects on both fixed income and equity markets.

The supply and demand of U.S. treasuries, in both domestic and international capital markets, plays a crucial part in the adjustments of the yield curve and capital movements. In the wake of weakening demand for U.S. treasuries in international markets, the 10-year treasuries yield has risen, which could present an attractive opportunity for new investors to capitalize on the higher yield environment for their investments.

In this article, we will take a closer look at the rationale for China to potentially halt the purchasing of U.S. debt and its implication on the capital markets in the U.S.

Keep our glossary of municipal bond terminologies handy to familiarize yourself with different concepts commonly used by municipal investors.

China’s Holdings of U.S. Debt

China holds the biggest reserves of foreign-exchange assets in the world, which are currently valued at above $3.1 trillion they hold around $1.2 trillion in U.S. debt. In China’s attempt to potentially hedge its risk on investment holdings and strive to reach an efficient frontier, it has begun to revisit its investment strategy and possibly look for alternatives to U.S. government debt for its reserve. There is no clear specification from China on its potential cutbacks on buying American debt, but the tension trades between the U.S. and China might be one of the reasons.

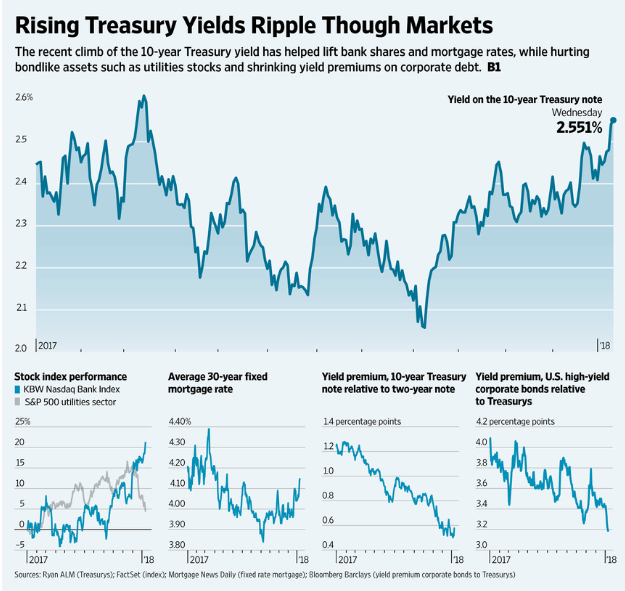

The news of Chinese officials’ recommendation to reduce or halt buying of U.S. government debt was taken quite seriously in U.S. capital markets; when there was a government debt selloff in the market, the 10-year U.S. treasury yield benchmark rose to its height for the past 52 weeks, sending a ripple effect into various capital markets in the U.S. As many investors know, the bond prices and bond yields are inversely correlated, so the decreased demand for U.S. government debt has put upward pressure on treasury yields and lowered the value of underlying assets. The 10-year yield benchmark is critical for both domestic and international markets on their assessments of risk on different investment instruments like increasing mortgage rates and enhanced performance of equity markets as shown in the graph below. This trend of low demand for treasuries isn’t unique to China; it’s unanimous with the whole foreign demand. Recently, the Bank of Japan introduced its 5% cut to its bond purchases, followed by a substantial reduction to the European Central Bank’s bond purchases.

Discover bonds offering attractive yields using our tool. Recent bond trades.

While you explore recent muni bond trades, you can also keep a tab on the different ways to invest in muni bonds to stay up to date with current investment strategies.

Potential Opportunities for Investors

In the wake of weakening demand for U.S. treasuries and rising yields, the Municipal bond sector presents some very attractive opportunities for investors looking to capitalize on the discounting of existing debt and rising Muni-to-Treasury ratios for local government sector debt instruments. The Municipal-to-Treasury (M/T) ratio is a simple comparison between the current yield on a AAA municipal debt with a 10-year maturity with the 10-year treasuries yield. Along the same line, if the M/T ratio rises, it means that municipal debt with similar risk is returning an increasingly higher yield in comparison to U.S. treasuries, and municipal debt presents an attractive option to buy over U.S. treasuries. In addition, municipal debt is often triple tax exempt and investors might be willing to accept the lower yield on municipal debt, knowing that the overall tax-free yield might be higher on the munis vs. U.S. treasuries.

Municipal yields have seen a significant surge on Chinese news and might soon surpass the treasuries yield benchmark for similar maturities: both the 10-year muni benchmark yield and 30-year muni benchmark yield were trailing their treasury counterparts by small margins. The 10-year municipal benchmark rose to 2.331%, the day after the China news broke, where the 10-year treasury benchmark rose to 2.551%. The 30-year General Obligation yield benchmark also rose to 2.72%, where the 30-year treasuries were 2.89%. It is important to note that decreased demand for treasuries should not have had a greater impact on munis than on treasuries. Seeing as muni-to-treasury ratios have gone up significantly after the news, this provides investors with an opportunity to buy Munis at a higher yield, while the demand for munis is not fundamentally affected by the news.

While you compare the recent movements of muni bond yields, you can check one of our previous articles here that highlights five of the most active muni bonds.

The Bottom Line

The supply and demand of U.S. treasuries affect almost every aspect of the capital markets; hence, some assets can potentially be under-priced in the short term and provide a buying opportunity for investors, as Munis seem to be providing in this case. Investors must carefully analyze their investment holdings and assess the overall impact of these global events. Investors must consult with their financial advisors and tax consultants on their holding and it’s important to understand the tax status and risk assessment of any fixed income instrument that you buy in the future, as it might have changed.

Be sure to check this article to remain aware of the due diligence process for evaluating municipal bonds.